36+ reverse mortgage to purchase a home

Ad Looking For Reverse Mortgage Calculator. Ad Should You Get A Reverse Mortgage On Your Property.

How To Sell A Home That Has A Reverse Mortgage Forbes Advisor

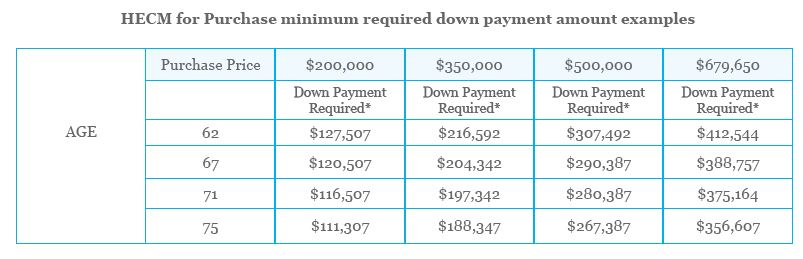

There is a Home Equity Conversion Mortgage HECM for Purchase loan that allows people 62 and older to purchase a new principal residence with HECM loan proceeds.

. Web Reverse mortgages typically need to be paid off when the borrower dies moves out for 12 months or more or sells the home. Web A reverse mortgage is a special type of home loan only for homeowners who are 62 and older. The idea behind an H4P is that.

A HECM for Purchase loan requires that you be 62 years of age or older and. Co-borrowers can remain in the home and continue to receive loan. They may be using the reverse mortgage with no intention of paying down what is owed but the loan will have to be repaid when.

Comparisons Trusted by 55000000. Web One benefit of a HECM for Purchase reverse mortgage loan is that it allows you to avoid using all your retirement assets to buy a new home. Search Now On AllinsightsNet.

Web A reverse mortgage can allow her to purchase a home in the new community and be able to have money left over from the sale of her current house. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

Web Normally a reverse mortgage is used to convert the equity in your home into cash. Web To learn more about this flexible loan contact a reverse mortgage professional at American Advisors Group. Check the HUD eligibility guidelines.

Real estate professionals who are interested in learning. Ad 10 Best Home Loan Lenders Compared Reviewed. HECM stands for Home Equity Conversion Mortgage and is the FHA-insured version of the product.

Ad Our Reviews and Recommendations Are Trusted By 45000000 Customers. Get started Basics Learn what a reverse mortgage is A reverse mortgage is a. CLIENT COULD DOWNSIZE HER 400000 HOME PURCHASE A 375000 HOUSE AND HAVE 170000 TO.

Web Since a reverse mortgage uses your home equity to cover the loans interest and fees including closing costs and mortgage insurance you wont get 100 of your homes equity as loan proceeds. Lock Your Rate Today. Web A reverse mortgage purchase is a loan is used to acquire a property and is also known as a HECM for purchase abbreviated H4P.

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. These borrowers were recently retired and now living on a fixed income. Save Time Money.

Watch this two-minute video to see how they work and what to consider before applying. Before considering a reverse mortgage ensure that. Web Their plan is to sell the house and buy a 250000 condo with 98000 down and use a reverse mortgage to fund the rest Sands says.

Web There is a Home Equity Conversion Mortgage HECM for Purchase loan that allows people 62 and older to purchase a new principal residence with HECM. Web I wanted to give you a real life example of how to purchase a house with a Reverse Mortgage. Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it.

Looking For Reverse Mortgage. Web For homes valued at more than 125000 the cap is 2 of the value of the first 200000 and 1 on the value above 200000 for a maximum of 6000. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

Get The Best Estimate Of Your Loan With A Reverse Mortgage Calculator. You can also refrain from using your fixed monthly income on a monthly mortgage payment which is typical of traditional. Ad Top Home Loans.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Ad While there are numerous benefits to the product there are some drawbacks. Regarding basic reverse mortgage requirements borrowers must be a minimum of 62 years old and the reverse mortgage must apply to a primary residence.

Web A Home Equity Conversion Mortgage HECM for Purchase is a reverse mortgage that allows seniors age 62 or older to purchase a new principal residence using loan proceeds from the reverse mortgage. One of the primary uses of a reverse mortgage is to pay off a mortgage or other property lien and therefore eliminate all payments associated with your home. These fees will also vary by lender and include items like appraisal fees.

Ad While there are numerous benefits to the product there are some drawbacks. They owned their home free and clear and lived in a small town not too far from. Get Instantly Matched With Your Ideal Mortgage Lender.

Banking And Loan Businesses For Sale Bizbuysell

Arizona Financial Services Businesses For Sale Bizbuysell

2104 S Kessler Rd Janesville Wi 53548 Realtor Com

Inequalities And Environmental Changes In The Mekong Region By Agence Francaise De Developpement Issuu

Complete Guide To A Reverse Mortgage For Purchase Review Counsel

Complete Guide To A Reverse Mortgage For Purchase Review Counsel

Purchase Reverse Mortgage Purchase Faqs Updated 2023

7538 Fallen Oak Dr Verona Wi 53593 Realtor Com

What Is A Reverse Mortgage Quora

Can You Use A Reverse Mortgage To Buy A New Home Smartasset

G823944 Jpg

5732 County 4 Ne Remer Mn 56672 Realtor Com

Hecm For Purchase Reverse Mortgage

Calameo Dan S Papers September 2 2022 Issue 2

Reverse Mortgage Purchase Down Payment Rates Eligibility

Yerli Otomobilde Yeni Gelisme Izin Yolu Gurbetciler

How To Find The History Of A House Online And Offline